The key financial planning lesson to learn from the market dip in August

Over the course of last month, you may have seen news of a significant and short-lived market dip in August.

By their very nature, stock markets rise and fall over time in response to all kinds of stimuli. That might be supply and demand, investor sentiment, or news that could affect company performance and economic growth.

Factors like these influence investors, who make decisions that are then absorbed by the market, creating small fluctuations over time.

However, it can still be concerning if markets dip substantially at once, as they did in early August. The release of key economic data in the US spooked investors, sparked a sell-off, and generated headlines as markets fell.

Yet, just a week later, the dip was all but over and markets had nearly fully recovered. This entire sequence may seem puzzling, but it’s actually a commonplace part of how markets work – and, it contains a key financial planning lesson.

So, find out why the market dip in August occurred, how markets quickly rebounded, and the lesson to learn from periods of volatility like this.

Concern in the US caused the biggest single-day market dip in 2 years

To begin with, it’s important to understand why the market dip occurred.

Essentially, a variety of factors combined to suggest that the US – the largest economy in the world – was heading toward a recession.

Firstly, the Federal Reserve – the US central bank – decided to keep central interest rates steady between 5.25-5.5% on 31 July.

Then, compounding this news, key US economic data came in weaker than expected. Sky News noted two key indicators that came in below expectations, and contributed to investors reacting strongly:

- US non-farm payroll figures, which measure how many jobs were added to the US economy in the previous month. 114,000 jobs were created in July, down from the Wall Street forecast of 175,000.

- The unemployment rate. In July, this was 4.3%, higher than the 4.1% prediction.

In combination, this data suggested that the US would record negative economic growth. With so much of global wealth invested there, this led to panic from investors who began selling stocks for fear of a market fall.

Thursday 1 August saw significant falls on some of the major US stock indices, including drops of:

- 2.5% on the S&P 500

- 1.9% on the Dow Jones

- 3.3% on the Nasdaq.

Furthermore, CNBC reported that over the course of the next few days, values on those indices fell even further, down by a total of:

- 7.3% on the S&P 500

- 5.4% on the Dow Jones

- 10.7% on the Nasdaq.

These figures are concerning, and you can understand why investors might have been tempted to sell up, hoping to avoid their holdings losing even more value.

The market dip ended as quickly as it began

Yet, despite the doom and gloom headlines throughout the start of the month, the market sell-off and dip was all but over just a week later.

In fact, as the Guardian reported on 8 August, Wall Street enjoyed the best trading day seen in nearly two years.

Those big three indices that fell so dramatically at the start of the month had recovered practically all the losses incurred on that first day of trading, with gains of:

- 2.3% on the S&P 500

- 1.8% on the Dow Jones

- 2.9% on the Nasdaq.

The S&P 500 figures are particularly noteworthy. Having suffered its worst day in two years with a 3% fall on 5 August as the Guardian reported, this 2.3% rise meant the index also saw its best day during the same period.

A quick turnaround like this may seem surprising, especially if you noticed the impact on your portfolio over this period. But, interestingly, a rapid recovery of this sort is not unusual.

As CNBC explained in March 2024 – months before this particular dip – the best and worst market days tend to fall near each other.

Research shows that over the past three decades, 10 of the S&P 500’s best trading days by percentage gain occurred during recessions.

Perhaps even more telling, the eight trading days between 9-18 March 2020 when markets were grappling with the effects of the Covid-19 outbreak contained:

- Three of the market’s 30 best days

- Five of the market’s 30 worst days.

Past performance is not necessarily indicative of future performance, and markets may not always respond in the same way. But, all this goes to show the immense difficulty of accurately predicting when a volatile market will reach peaks and lows.

These events show the importance of staying calm during periods of volatility

With the backdrop of this information in mind, the key lesson to learn from the August market dip is simple: stay calm and stick to your strategy amid periods of volatility.

As you’ve seen, market behaviour can be erratic and unpredictable, driven by many factors outside of your control. But crucially, it’s important to resist the temptation to react and make changes to your portfolio.

Instead, it’s vital to stick to your strategy, remain patient, and ride out periods of volatility. Otherwise, you could end up missing some of the market’s best days, losing value on your investments and potentially harming your ability to reach your financial goals.

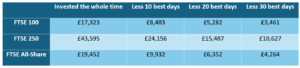

Figures from Schroders looking at the UK market show how this could happen. The data examines how a £1,000 investment made in three of the most important UK stock indices from 1986 to 2021 would have performed, depending on whether you’d remained invested throughout the entire period:

Source: Schroders. Past performance does not guarantee future performance.

As this data shows, missing even the market’s 10 best days could have a sizeable impact on your portfolio.

So, when markets are uncertain like they were in August, the lesson is simply to remain calm and keep your long-term goals in mind.

Get in touch

Have any questions about managing your investments during periods of volatility? We can help at Caliber Financial Management.

Email contact@caliberfm.co.uk or call 01525 375286 to speak to us today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.