Why picking “ins” and “outs” for 2025 could be more powerful than new year resolutions

Around 4,000 years ago, the ancient Babylonians – a civilisation living in southern Mesopotamia, which is modern-day Iraq – supposedly became the first humans to make new year resolutions.

During a new year festival held in March rather than January as it was harvesttime, the Babylonians would make resolutions to their gods and pledges to the king. Keeping their word would mean the gods would look favourably on them for the year ahead, but breaking these resolutions would mean falling out of the gods’ favour.

Of course, these days new year resolutions look a little different. They usually revolve around goals and habits we have for the year ahead, with YouGov reporting that the most common targets for 2025 include:

- Saving more/ spending less

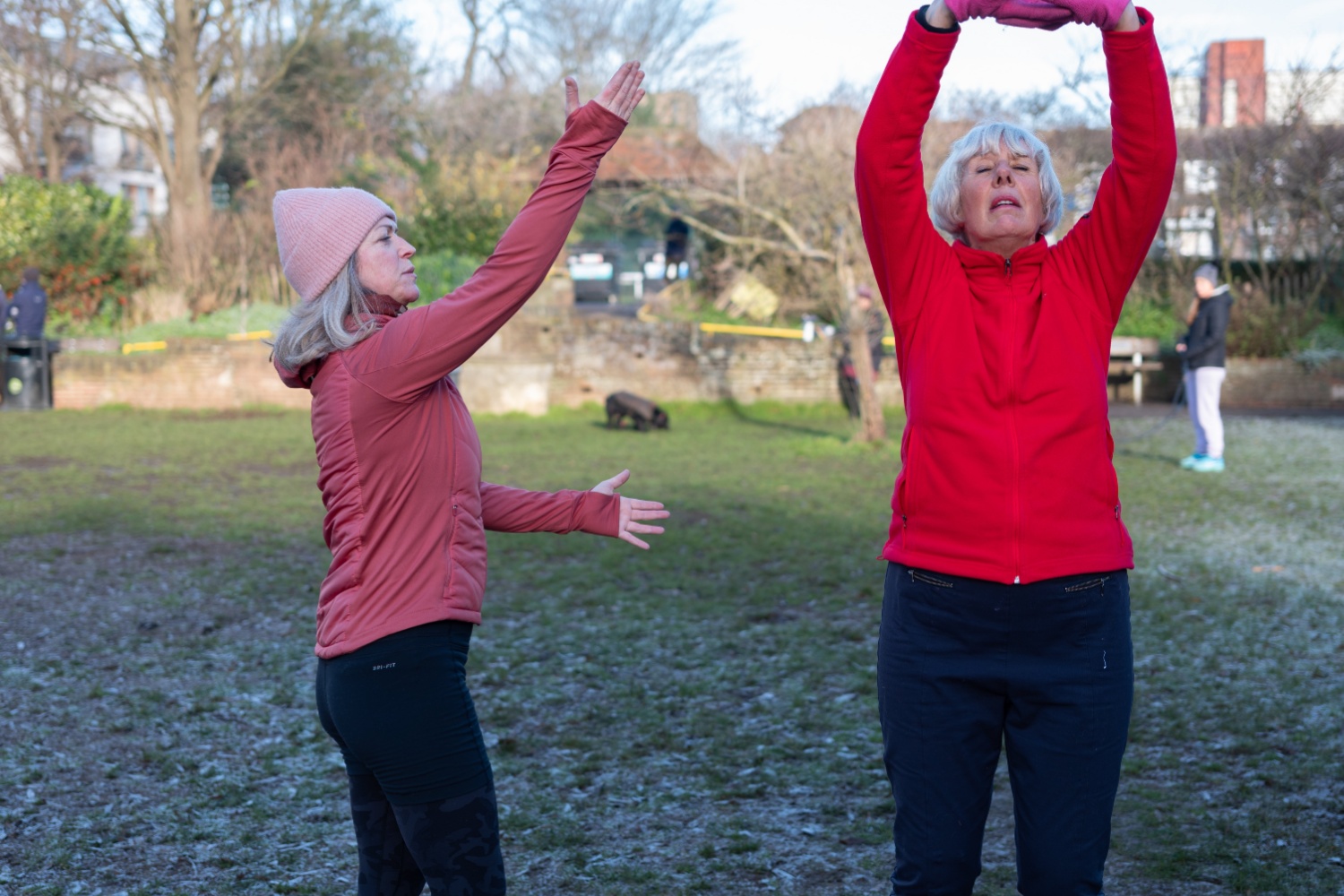

- Getting fit/ exercising more

- Losing weight

- Gaining new skills and knowledge

- Improving health.

You may well have made some resolutions for the new year yourself. These might well come from the list above, especially if you want to set the intention of bettering your wealth management.

Yet interestingly, while making resolutions like these could be useful, it could be more effective to think of this in terms of “ins” and “outs” – in other words, habits you want to bring in to your life, and those that you would like to take out over the course of the year.

Ins and outs could be a useful alternative to typical new year resolutions. So, find out why, and how you can go about putting them in place.

Only 1 in 3 people keep all their new year resolutions for the entire year

If modern standards are anything to go by, you would imagine that the first breaking of resolutions occurred just a few days after the initial ones were set in Babylon.

As you’ve no doubt been guilty of yourself, letting your new year resolutions go often occurs not long after you’ve put them in place. Indeed, according to the YouGov survey, only 1 in 3 (33%) of people who made resolutions for 2024 kept to them, with 45% saying that they kept to some but not all of theirs. A very honest 1 in 5 (19%) admitted to failing to keep any of the promises they set.

Part of the reason for this is that it’s all too easy to be overly ambitious with your new year resolutions. You might instantly try to go from zero to 100 with the goals you set yourself, whether that’s trying to exercise more, eat healthier, or even manage your finances more effectively.

This makes it all the more likely that you’ll get frustrated with not achieving your goal, and let it go because you haven’t seen any progress.

It’s also incredibly difficult to commit to changes like this and make them habits, especially if you don’t put steps in place to achieve them. Without thinking about how you will achieve your resolution and make it stick, it can quickly fall away as a priority.

This is where choosing ins and outs might serve you better.

Ins and outs offer a refreshing alternative to traditional new year resolutions

Selecting a range of ins and outs can be more effective than setting broader new year resolutions for multiple reasons.

In essence, ins and outs allow you to break down your goals for the year into specific, measurable habits that you want to stick to. The ins represent the positive side of your targets and how you want to go about achieving them, while the outs tend to be the habits you want to eliminate that hold you back from achieving your goals.

For example, instead of leaving yourself a broad resolution like “get fit for 2025”, you could choose some ins that will help you achieve this goal. That might be running a certain number of miles a month, going to the gym on fixed days, or adding certain foods to your diet.

Your outs then reflect the habits that might hold you back from that target. You might choose ones such as “skipping the gym” or “eating unhealthy snacks in the evenings”.

In doing so, you give yourself concrete steps to take toward your goal, rather than being bowled over by the enormity of the target.

This logic applies to your finances, too. To improve your wealth management, you might choose ins of “saving 20% of your income each month” or “getting your pension fund to a certain value”. Meanwhile, your outs could be “cutting down on unnecessary spending” and “dipping into savings to cover expenses”.

Even if your ins and outs are just the resolutions you would have set anyway, thinking about them in terms of the habits you want to incorporate in your life and those you want to kick can still be a valuable mental exercise. It allows you to reframe your targets for the year in this way, hopefully making you more likely to keep to your new habits.

You can refer back to your list or adjust it throughout the year

Alongside giving yourself clear steps towards your goals for the year, another of the major benefits of the ins and outs approach is that you have a fixed list you can refer back to.

These are measurable habits, and you’ll be able to assess how well you’re progressing towards your target each time you review your list.

You can also adjust that list as you go, adding more habits you’d like to include, ticking off any you might have completed, and refining the ones that need a bit of extra care and attention.

This approach can feel more rewarding, as you’re able to celebrate your successes without beating yourself over the head with overly ambitious resolutions you were likely never going to achieve.

Get in touch

If you would like support putting financial new year resolutions in place and making more effective decisions when managing your wealth in 2025 and beyond, then we can help at Caliber Financial Management.

Email contact@caliberfm.co.uk or call 01525 375286 to speak to one of our team today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.